Buying Real Estate & Saving Taxes: Why Depreciation (AfA) Is Such a Powerful Advantage

Many people know that real estate is a stable and reliable investment. But one major benefit is often underestimated: the tax advantages.

In particular, depreciation (AfA) makes buying an apartment or house as an investment property especially attractive.

Why Real Estate Is So Tax-Efficient

◾ Continuous depreciation reduces taxable income every year

◾ Financing interest is also tax-deductible

◾ Combination of rental income + long-term value appreciation

◾ Hedge against inflation and strong, stable returns

According to data from the German Federal Statistical Office, real estate prices in Germany rise on average 3–5% per year over the long term—despite short-term fluctuations. Meanwhile, demand for housing remains high, especially in urban areas.

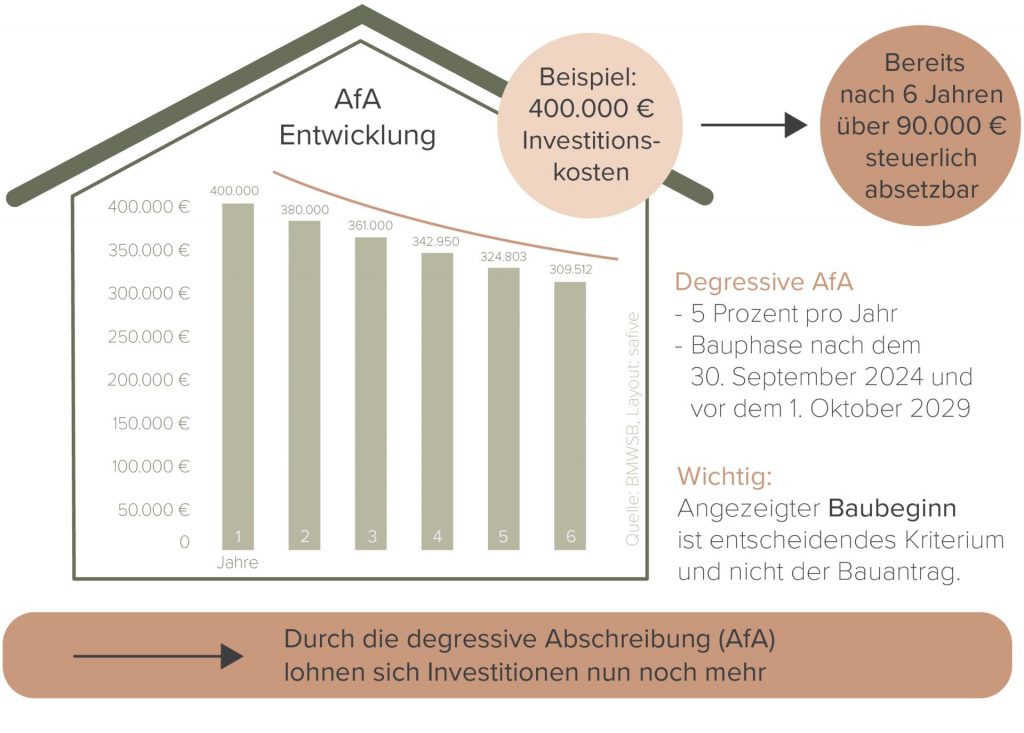

What Is Depreciation (AfA)?

The German Absetzung für Abnutzung (AfA) allows property owners to deduct the annual loss in value of a building from their taxable income.

In simple terms: A portion of the purchase price can be written off every year.

Current AfA Rates since 2023

3% per year for residential buildings (linear depreciation)

equivalent to a tax depreciation period of 33 years

Special cases (e.g., historic buildings, renovations, energy-efficient upgrades) may receive additional incentives.

Example: How Much Tax Can You Actually Save?

Let’s assume you buy an apartment as an investment property:

Purchase price excluding land: €300,000

AfA: 3% = €9,000 per year

Personal tax rate: 35%

Annual tax savings:

€9,000 × 35% = €3,150 less tax

Over 10 years:

€31,500 in tax savings.

◾ Depreciation makes real estate one of the most effective and completely legal tax-saving strategies for private investors.